The Dutch Pension System – How to Retire Like a Dutchie

The Dutch pension system is consistently recognised as one of the world’s leading retirement frameworks, having secured the top position in the Mercer Global Pension Index for several years. Despite its plethora of strengths, it can be very difficult to wrap your head around how retirement works in the Netherlands.

We aim to provide our readers with a practical starting point, so you can come up with a simplified employee pension plan. This article will focus on the three main pillars of the Dutch retirement system.

The Three Pillars of the Dutch Pension System

The Dutch pension system is based on a robust three-pillar structure. It is a pay-as-you-go arrangement where working individuals contribute to a shared retirement pot, which is then redistributed according to each person’s defined pension plan.  Most people need a combination of two of the pillars listed below to ensure they are accumulating enough income to cover their living costs.

Most people need a combination of two of the pillars listed below to ensure they are accumulating enough income to cover their living costs.

These pillars are:

- State pension (AOW)

- Occupational pension

- Private pension

State Pension (AOW – Algemene Ouderdomswet)

Everyone who is part of the public employee retirement system in the Netherlands receives state pension, also called AOW pension. Formally known as the Algemene Ouderdomswet (Dutch General Old Age Pensions Act), it constitutes the first pillar of the Dutch pension system and forms the foundation of retirement income in the Netherlands. AOW provides the essential income for residents when they reach the Dutch retirement age. State pension is administered by the Social Insurance Bank (SVB) and funded by social insurance contributions. Simply put, the collected funds cover the pensions of current and future retirees.

- Who is eligible? Individuals who have lived or worked in the Netherlands between the ages of 15 and 67.

- What is the AOW age? The AOW pension age is tied to life expectancy and periodically adjusted. In 2025, it is set at 67 years.

- What amount do you get? This is different for every individual. State pensions use a defined benefit pension plan, meaning the amount is calculated based on the number of years spent living in the Netherlands. The full AOW pension is earned after 52 years.

- Is it tax-free? Contributions are tax-free, however once you start receiving your pension, it will be subject to income tax. Learn about the AOW pension in detail.

Occupational Pension (Werkgeverspensioen)

Even though occupational pension is not mandatory for employers, most employees in the Netherlands automatically participate in Werkgeverspensioen – a workplace pension scheme, via their employer.

This high coverage rate is largely due to sectoral collective labour agreements that mandate participation in industry-specific pension funds. Employers operating within these sectors are obliged to enrol their employees in the corresponding pension schemes. For companies outside these sectors, offering a pension plan remains optional, but many choose to do so to remain competitive in attracting and retaining talent.

These funds are financed by employers and employees through their contributions and investment returns and are part of the employer’s burden. An occupational pension is mandatory for employers in many sectors, but there are some exceptions. It usually provides the substantial sum of your retirement funds.

- Who administers it? Non-profit pension funds or insurance companies.

- Who contributes to it? The employer and the employee. Roughly 2/3 comes from the employer, and 1/3 from the employee.

- What is the amount? It can vary between 4-8% (but in some cases can go up to 30%) of your monthly pensionable salary. Occupational pension in the Netherlands will see some changes by 2028 due to the Future Pensions Act (Wet toekomst pensioenen).

- Who is eligible? 90% of employees are eligible for an occupational pension, including some self-employed workers, specifically doctors, notaries, painters, plasterers and others.

Advantages:

- Often includes survivor’s pension and disability benefits.

- Contributions are partially tax deferred.

Private Pension (Aanvullend Pensioen)

The third pillar – private retirement schemes feature voluntary, individually arranged pension products, such as annuities or tax-efficient savings accounts. Private pension savings are especially important for freelancers (ZZP’ers) and those with insufficient accrual through employment, which is why they are often called supplementary pensions. But really anyone can choose to benefit from a private retirement scheme.

- Who distributes it? Banks and insurance companies.

- Who is eligible? The self-employed, freelancers (ZZP’ers), anyone who wants to add to their pension fund.

- What are the advantages? You have greater control over when and how your supplementary pension is received, and in some cases, it can be transferred to your next of kin if you pass away.

Options include:

- Annuity-based pension insurance (lijfrenteverzekering)

- Bank savings accounts (banksparen)

- Investment accounts

- Life insurance

- Property investments

- Stocks

Tax Benefits: Contributions may be tax-deductible depending on your annual pension gap (jaarruimte).

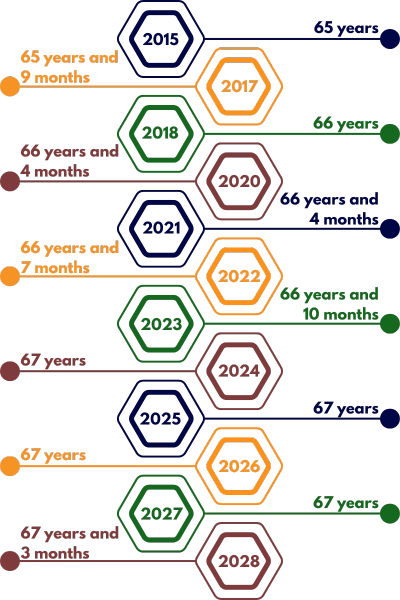

What Is the Retirement Age in the Netherlands?

Currently the Netherlands’ retirement age is 67 years. The retirement age is closely tied with longevity projections, and will rise incrementally, expected to reach 67 years and 3 months in 2028. You can use this retirement age calculator provided by SVB to find out when you will reach the Dutch retirement age.

Currently the Netherlands’ retirement age is 67 years. The retirement age is closely tied with longevity projections, and will rise incrementally, expected to reach 67 years and 3 months in 2028. You can use this retirement age calculator provided by SVB to find out when you will reach the Dutch retirement age.

Is It Possible to Retire Early?

If you decide to begin your retirement early, you are free to do so, but you won’t receive your state pension until you reach the Dutch retirement age. This means you will need to secure an alternative source of income to support yourself in the meantime.

In some cases, you might be able to receive your occupational and private pension early on as well, but you may need to visit a pension office or speak to a consultant/your pension provider to find out the specifics.

In the opposite scenario – you may choose to begin your retirement later, past the Dutch pension age. However, this will not alter the timing of your first state pension payments, which will still begin once you reach the official retirement age. There are exceptions for those benefiting from a supplementary pension.

Living Abroad and Receiving Dutch Pension

Pensioners living outside of the Netherlands are sometimes eligible to receive their retirement benefits, but this depends on the country they relocate to. You can find more information on the topic on the SVB website.

Those who consider moving abroad for a set period can continue making payments to their Dutch pension fund from abroad. Those residing in EU countries are generally more likely to continue adding to their occupational and private pension funds. As there are some exceptions to the amount of time you can do this (usually up to 10 years) it is advisable to contact your pension provider or visit a pension office for guidance.

If you relocate to another country, you may be able to transfer the Dutch pension you have accrued. However, it is important to consult your Dutch pension fund to understand the potential consequences.

It is common that expats lose track of their pension rights when they move, and it’s every individual’s responsibility to keep track of them. The pensions regulator isn’t responsible for transferring your pension rights as an expat.

Where To Check Your Pension

You can view the amount of state pension being deducted on your payslip or visit mijnpensioenoverzicht.nl for a detailed breakdown. You can also view projections of your future retirement plan.

Pensions and Investments – Alternative Options for Wealth Management

Some individuals choose other ways to keep themselves covered during their retirement. To combat inflation and rising longevity, retirees and future retirees are encouraged to:

- Invest in low-cost index funds

- Consider annuity products

- Utilise tax-friendly savings schemes, known as lijfrente

Overview

Although the Dutch pension system offers substantial benefits, its complexity – stemming from frequent legislative changes and the interplay between its three pillars, can make it challenging to navigate. Understanding the structure we outlined above is an essential first step for anyone seeking clarity on their future retirement prospects in the Netherlands. Let’s summarise:

The Dutch public employee retirement system is made up of three pillars – state pension, occupational pension and private pension. Employees contribute to a shared pot of retirement funds via their state pension, which gets redistributed to each individual when they reach the retirement age in the Netherlands.

A greater chunk of your retirement is funded via occupational pension (the second pillar). Not everyone is eligible for this workplace pension, which is why the third pillar – private pension pots exist. You can choose to make additional payments to your pension (up to a certain amount) if you want to increase it.

If you are an expat or professional considering a career move to the Netherlands, understanding the pension system is crucial when evaluating job offers and planning your future. Many recruitment agencies, such as Blue Lynx, can provide guidance not only on employment opportunities but also on navigating Dutch pension schemes as part of your relocation and career planning process.

It’s never too early for you to begin thinking about your retirement. Our advice is to get started on a defined pension plan as soon as possible.