Why Choosing an EoR Might Save Your Business Thousands

Companies considering expanding their business in the Netherlands are likely weighing up whether to set up their own back office or use an Employer of Record (EoR). Cost is a key factor here – using an EoR means you pay a clear, predictable fee to have all your payroll, HR and compliance handled for you, while running your own back office gives you more direct control but comes with extra admin, legal and compliance responsibilities and often higher, less predictable costs. Both options are viable, but the right one depends on your company’s needs and growth strategy.

To help you make the right choice, we’ll explain what’s involved in managing your own Dutch entity compared to working with an Employer of Record, and how the costs stack up for each option.

What Is a Company Back Office?

An in-house back office is a team (or several teams) within your company, whose responsibility is to handle the administrative HR and payroll, finance, and operational processes. These teams are internal and under your direct supervision, usually situated on your premises.

While an in-house back office gives you more direct control, it also means you’re responsible for hiring local staff, managing legal compliance and covering a wide range of overhead costs.

What Is an Employer of Record?

An EoR – meaning an Employer of Record- is a third-party organisation that legally employs workers on behalf of another company. It enables businesses to hire internationally and locally without setting up foreign legal entities. EoR is a payroll service and an administrative employer that also handles and assumes responsibility for taxes, benefits, compliance and local labour laws.

Employer of Record Cost in the Netherlands – How it Works

The Employer of Record pricing is often more predictable and manageable than the expenses involved in setting up a local entity or your own back office. With an EoR, you pay a service fee – typically a percentage of payroll or, in our case, a flat monthly rate, which covers all administrative, legal and compliance functions.

This approach is especially cost-effective for companies planning to hire fewer than 15 employees in the Netherlands within the next couple of years, as it eliminates the need for local infrastructure and reduces your exposure to Dutch regulatory complexities.

When you add it all up, if the total price for our Employer of Record service is somehow the same as running an in-house back office (albeit that is near impossible in the Netherlands), the reduction in administrative burden and risk often makes the EoR model the preferred choice for new market entrants and scale-ups.

According to Deloitte, over 57% of companies expanding into new markets now choose EoR before committing to full entity setup.

Our service in the Netherlands is priced at a flat €599 per month per employee (excluding employment costs), covering:

- Local employment compliance

- Payroll processing

- Employer tax filings

- Mandatory employee benefits

- Employment contracts and onboarding

- Termination handling

- HR support

What Is the Entity Setup Cost in 2025?

Expanding into the Netherlands presents a compelling opportunity for global companies, but how you enter matters. Businesses looking to register in the Netherlands need to set aside a budget for formation costs – this goes beyond paying a registration fee at the Chamber of Commerce. Become familiar with the additional expenses you can encounter when setting up a local entity, to decide if this is the right path for your organisation.

Entity Formation Costs

- Registration fee at the Dutch Chamber of Commerce (KVK) – This is a one-off fee.

- Minimum share capital – Since 2012, the minimum share capital for a BV is just €0.01, but you may want to deposit more to cover initial expenses.

- Notary fees – You need a notary to draft and notarise the Articles of Association. These fees typically range from €500 to €1,500, depending on complexity.

- Legal and consulting fees – Depending on your exact requests, for legal advice and company formation services, you may need to add €1,000 to €5,000 or more to your entity formation budget.

- Office rental – Renting a physical office varies widely, but virtual office services for a registered address cost around €90 to €200 per month.

- HR support – Even if you don’t hire an internal HR team, a freelance HR professional can cost you anything between €120 and €160 per hour (excluding tax).

- Payroll specialist – For just 24 hours, hiring a payroll specialist can amount to approximately €2500 in the Netherlands.

Using an Employer of Record at €599/month per employee would come to a total cost of €7787 annually.

Not to mention, clients who choose to pay for a full year upfront will receive a discounted price of €499/month.

On the other hand, setting up a Dutch business entity, hiring HR/payroll staff, managing compliance, and leasing an office could easily exceed €70,000 annually, and we’re not even counting the time you spend on research and the possible liability risks that come with handling your own back office in a foreign country.

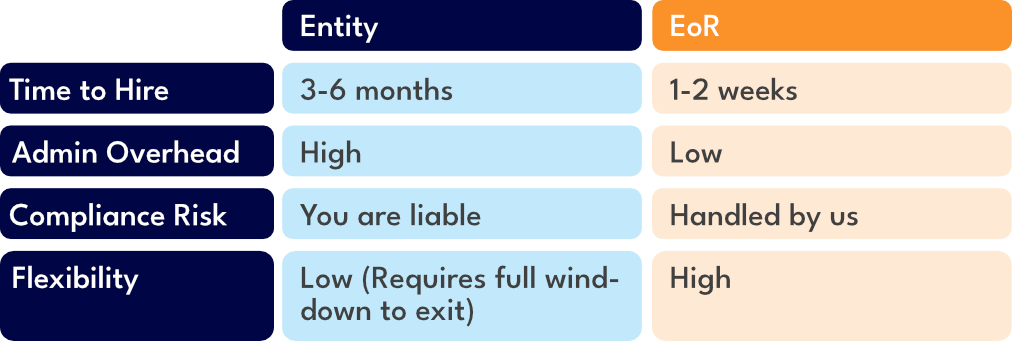

Operational Timelines

Opting to manage your own business setup and formation costs can prove not only expensive but also extremely time-consuming. The majority of government and institutional websites are written in Dutch, including the documentation you must fill out, so translating these resources often adds another layer of complexity and delays to the process.

The response times of these institutions can be unpredictable, which can further delay your registration process.

Compliance & Risk

The Netherlands is regarded as one of the strictest countries in Europe when it comes to regulatory compliance. Many new businesses are unfamiliar with the complex and layered structure of the Dutch administrative system and the obligations placed on employers.

As a result, when you choose to register a business independently, you assume full responsibility for any associated risks. By contrast, with us acting as your administrative employer, we ensure that all processes fully adhere to local Dutch law.

Partnering with a trusted EoR and recruitment agency like ours can help you devise the right strategy and make sure your expansion is handled in the most cost-effective and compliant way.

Choosing Blue Lynx EoR Services is Perfect for:

- Hiring your first employees without a long-term infrastructure

- Testing the market before full expansion

- Risk-free & fast setup

- Fully compliant contracts, benefits and tax handling

- Avoiding legal liabilities and local complexities

When Entity Setup Might Make Sense:

- Hiring 20+ employees with a long-term strategy

- Need a Dutch business license or VAT registration

- Operating a customer-facing physical office

- Accessing government subsidies or local tenders

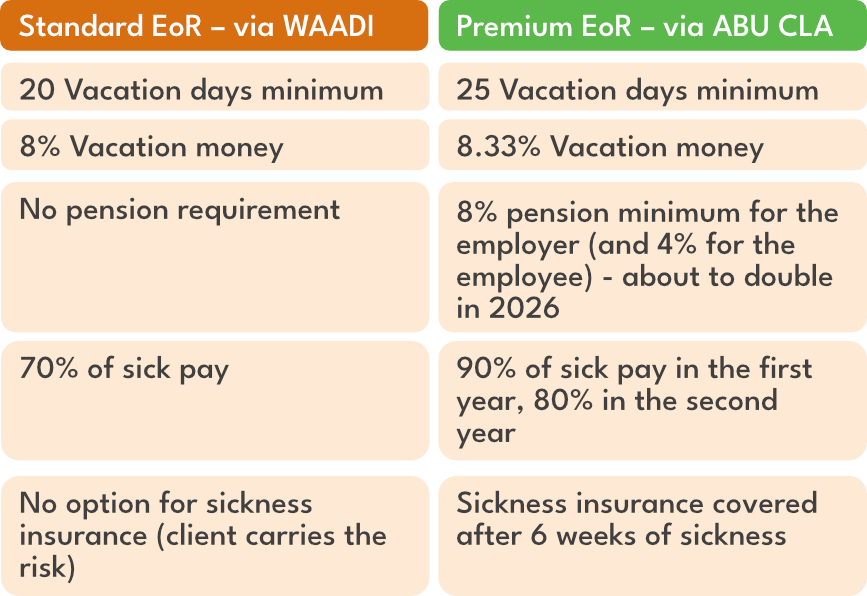

The Two EoR Models

Your expansion strategy should reflect your individual business goals – the best EoR companies will tailor their services to fit your needs, not the other way around. You might be a tech startup launching in Amsterdam or a Chinese logistics firm hiring in the Netherlands. Our consultants can help you select the best plan to fit your goals.

Additional EoR Services

Aside from these two models, your business can benefit from:

- Recruitment & Executive Search

- Relocation Services

- VISA & 30% Ruling Applications

- Legal & Accounting Referrals

- Equipment Delivery & IT Service

For some, a hybrid approach – starting with an Employer of Record and moving toward entity formation might be the ideal path. Take a look at our real-life use cases to find out the various ways you can benefit from this solution.

Our Thoughts

For companies expanding into the Netherlands in 2025, our Employer of Record offers a faster, more cost-efficient and lower-risk solution – especially during early-stage market entry. By outsourcing to an EoR payroll service, your business can focus on core activities, such as growth and talent management, while leaving the intricacies of Dutch employment law to local experts.

It’s unlikely you’d find an HR or payroll specialist or secure regular legal advisory services in the Netherlands for €599 per month, let alone less. In many ways, using an EoR eliminates the hassle of piecing together a team or dealing with local labour codes on your own.

Get in touch now to discover how our Employer of Record services can seamlessly handle your global workforce needs, so you can focus on what matters most – getting the job done.